URLA: Updates, Improvements, and Deadlines

Understanding the New URLA

The new URLA is bringing us into the 21st century. Along with improving accuracy and the clarity of information being provided by the borrower, the coming changes will make the process more efficient for lenders. As with all changes, there is a learning curve. The key to preparing for a smooth transition is understanding the changes, identifying where they will be on the new forms and beginning testing to eliminate workflow interruptions.

The New Forms and How They Work Together

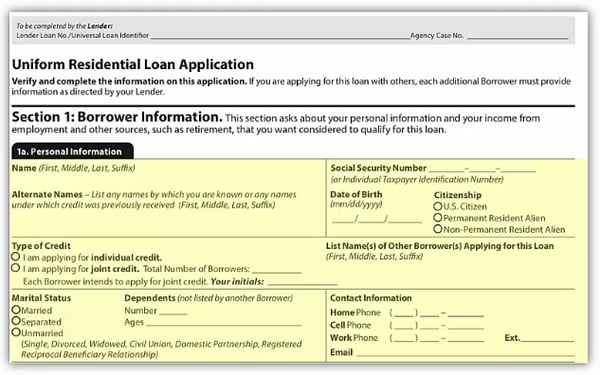

The Borrower Information Document is the main application form and the first form you will notice with formatting changes. The new layout now has a similar format to the LE and the CD which will make adoption much quicker. This form contains most of the information collected on the current 1003. Generally, one of these forms will be completed per borrower instead of seeing borrower and co-borrower on one application. It is important to note however, that you will see a combination of assets and liabilities for joint borrowers.

Changes in Section 1

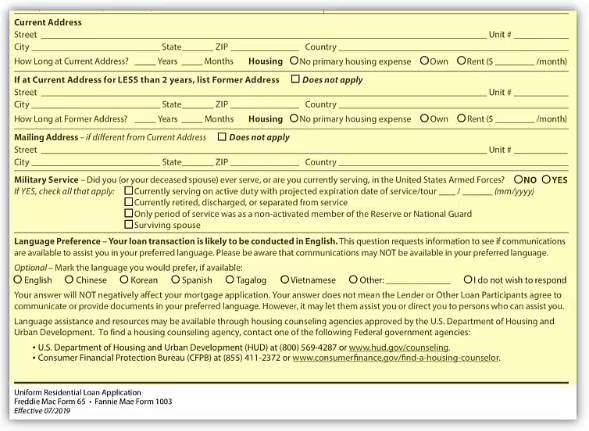

The first change to note is at the top of page 1. The paragraph referencing joint borrowers has been replaced by a space for the Lender Loan No. / Universal Loan Identifier. Starting in Section 1, where you would normally see borrower and co-borrower side-by-side, the form will now collect individual data starting with personal information. This is also where the borrower will indicate if they are applying for individual or joint credit.

The next change in this top section is the addition of fields for an email address and cell phone.  There are two new sections within the personal information section of the Borrower Information Document.

There are two new sections within the personal information section of the Borrower Information Document.

- Military Service - This section collects information about Military veterans that can be used by the Veteran's Administration

- Language Preference - This new section allows the borrower to indicate their preferred language. This informational question does not commit the lender to conduct the loan in the selected language.

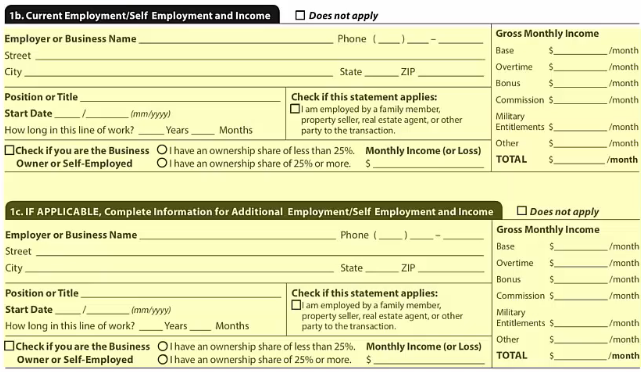

The new Employment and Income section has been improved by including those fields side by side for a more streamlined workflow. This new form supports the collection of loan application details that make it easier for underwriters to verify the income by source. For example: Employment entries include the income received at each employer and calls out other sources of income separately. Section 1e, Income from Other Sources, is the first part of the form that asks the borrower to select from a provided list

Section 2

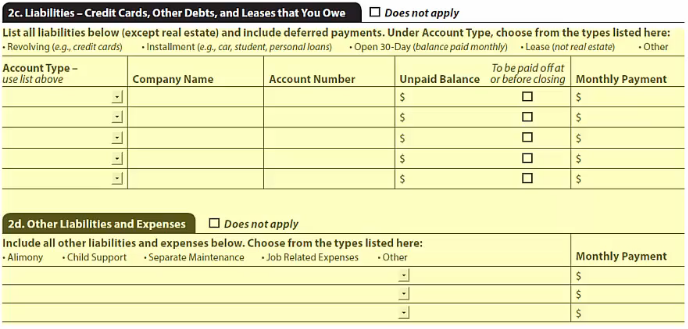

Assets And Liabilities

This is where information from the borrower with regard to their assets and liabilities will be collected. In sections 2a and 2b, there are fields for collecting bank accounts, retirement, and other accounts. Similar to the last section, users will now be selecting from the categories that are provided. For other assets, for example, you would put earnest money, sweat equity or other additional assets that the borrower owns. Also note that this section includes a does not apply checkbox, and if that were true, this would be selected, and the section would collapse in the dynamic version of the form.

Section 3

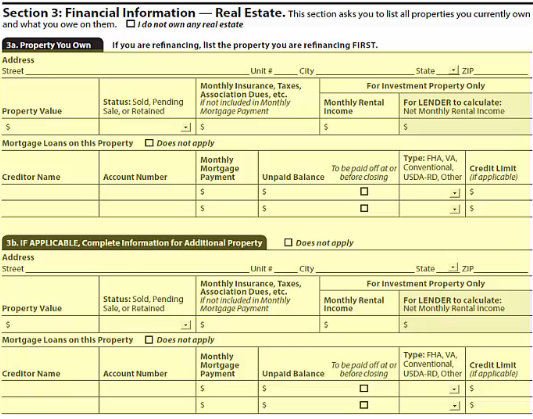

Real Estate

In the new Real Estate section the table now includes the existing mortgages associated with each property instead of listing them in a separate Liability Section. Here the borrower will list the real estate that is owned by the property address, including certain detail about the property, such as the property value, whether or not they are going to sell it in this transaction, and whether or not there's any rental income from that property. Immediately below that, will be a field to list any mortgages that exist on the property. This section, as with other sections in the dynamic version, will repeat as necessary until all real estate is listed.

Section 4

Loan & Property Information

This is the first place on the form that you will see any actual loan information being entered.

In addition to the three choices in the occupancy field there is now a fourth option added for FHA Secondary Residence. Underneath occupancy are two new questions referencing mixed-use property and manufactured home.

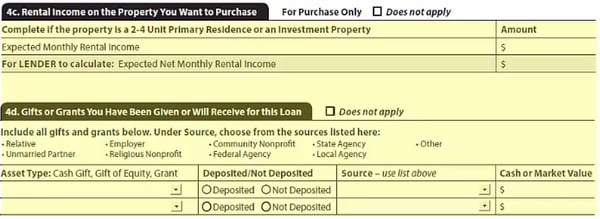

There are three new sections as part of the Loan and Property Information.

- 4b allows the borrower to list any other new mortgage loans being taken on the property being bought or refinanced. If there are no additional loans, the borrower will check the “Does not apply” box and the section will collapse. If there are additional loans, the borrower will add the creditor name, lien type and position, and amount.

- 4c is for rental income on purchase loans. The top line allows the borrower to provide expected gross monthly rental income for purchase loans. The lender then calculates the expected net monthly rent income amount. This section applies when the subject property is a 2-4-unit primary residence or investment property.

- 4d is where the borrower will report any gifts or grants that they will receive to help cover the cost of the loan by selecting from the provided list. The borrower would report the asset type, if the amount has been deposited, the source, using that list above, and then the value. This section will also be dynamic and expand or collapse as needed.

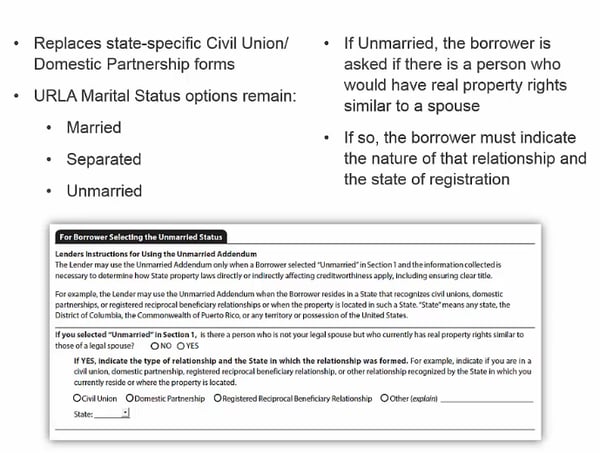

Unmarried Addendum

Important Deadlines for URLA

Beginning July 1, 2019, both Fannie Mae and Freddie Mac will allow the use of the redesigned Uniform Residential Loan Application ("URLA") published jointly by the Government-Sponsored Enterprises ("GSEs"). DocMagic systems will be updated to accommodate these new forms for loans with application dates of July 1, 2019 or later.

How do I learn more?

The new URLA form introduces many changes in the way borrower information is captured and displayed, including bolstering certain areas of the application such as income verification, military service, assets and liabilities, homeowner counseling, and more in depth property information. For a complete overview of the new functionality we have prepared the following resource page and strongly encourage our DocMagic customers to become familiar with the new content and system changes. DocMagic URLA Resource Page

Let us digitally transform your mortgage process for increased efficiency and ROI. See how by scheduling a demo today.

Topics from this blog: Compliance GSEs

BackSearch the Blog

- Recent

- Popular

- Topics

List By Topic

- Compliance (100)

- eClosing (85)

- Awards (72)

- eSign (71)

- Integrations (57)

- Industry Publications (52)

- Total eClose (44)

- eNotes (34)

- Remote Online Notarization (31)

- Document Generation (30)

- eDisclosures (25)

- GSEs (18)

- eVault (18)

- eNotary (16)

- SmartCLOSE (13)

- LoanMagic (12)

- eDelivery (11)

- Partnerships (8)

- Philanthropy (8)

- Industry Insight (5)

- AutoPrep (3)

Subscribe Here

Download the Truliant Federal Credit Union Case Study

Truliant took several key steps to refine its 100% digital eClosing process — including finding the right technology partner.