IRS releases new form 4506-C

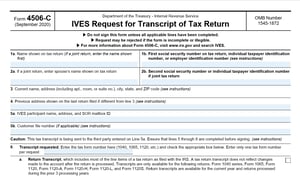

The Internal Revenue Service (IRS) recently released a new version of Form 4506, as Form 4506-C, IVES Request for Transcript of Tax Return (version September 2020).

Previously, the IRS posted an updated Form 4506-T (version June 2019) which removed Line 5a, which covers mailing tax transcripts to third parties, and replaced the “Caution” statement after Line 5 with the following “Note: Effective July 2019, the IRS will mail tax transcript requests only to your address of record. See What’s New under Future Developments on Page 2 for additional information.” This updated version of Form 4506-T could no longer be utilized for third party tax transcript requests, but the IRS continued to accept the prior March 2019 version which does allow for third party requests.

How a new lender found success amid the pandemic: Download the MortgageCountry case study

With the release of the new Form 4506-C, the IRS announced it will only continue to accept Form 4506-T (version March 2019) for all tax transcript order requests through Feb. 28, 2021.

With the release of the new Form 4506-C, the IRS announced it will only continue to accept Form 4506-T (version March 2019) for all tax transcript order requests through Feb. 28, 2021.

Starting March 1, 2021, only Form 4506-C will be accepted for use by authorized Income Verification Express Service (IVES) Participants to order tax transcripts records electronically. Line 5a of the new form allows for participating IVES Participants information to be entered.

DocMagic postponed changing to Form 4506-T (version June 2019) and has continued to provide the March 2019 version of the form so that it could continue to be used by all customers and our IVES partners.

DocMagic will make the new Form 4506-C (DocMagic Form ID: 4506C.MSC) available upon request starting Nov. 19, 2020. Currently, DocMagic is working on implementation with IVES partners and awaiting guideline updates to be made by agencies and the secondary market to allow use of the new form. DocMagic will announce the default addition of Form 4506-C to initial and closing packages in the coming weeks.

Should you have any questions, please contact DocMagic’s Compliance Department at compliance@docmagic.com.

Related Content:

Let us digitally transform your mortgage process for increased efficiency and ROI. See how by scheduling a demo today.

Topics from this blog: Compliance Industry Publications

BackSearch the Blog

- Recent

- Popular

- Topics

List By Topic

- Compliance (100)

- eClosing (85)

- Awards (72)

- eSign (71)

- Integrations (57)

- Industry Publications (52)

- Total eClose (44)

- eNotes (34)

- Remote Online Notarization (31)

- Document Generation (30)

- eDisclosures (25)

- GSEs (18)

- eVault (18)

- eNotary (16)

- SmartCLOSE (13)

- LoanMagic (12)

- eDelivery (11)

- Partnerships (8)

- Philanthropy (8)

- Industry Insight (6)

- AutoPrep (3)

Subscribe Here

Download the Truliant Federal Credit Union Case Study

Truliant took several key steps to refine its 100% digital eClosing process — including finding the right technology partner.