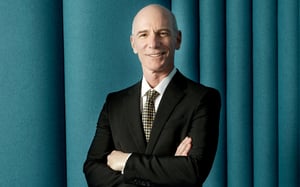

DocMagic’s CEO honored with Lending Luminary Award

DocMagic CEO and President Dominic Iannitti was named a Lending Luminary award winner by the PROGRESS in Lending Association. The honor, now in its 2nd annual year, was awarded to just 25 people across the mortgage industry, including bankers, lenders, servicers, technology executives, consultants, and more.

“Right now the market is filled with uncertainty, but these true Lending Luminaries are better handling and navigating the constantly fluctuating market conditions,” PROGRESS in Lending stated in announcing the award. “These executives deserve to be recognized for their industry vision and leadership.”

I annitti was selected thanks to several key accomplishments over the last year that led DocMagic to success. One of the main accomplishments was the April launch of AutoPrep, a new technology that leverages AI, OCR, and machine learning technologies to fully e-enable a document for paperless eClosings. This means any loan document from virtually any provider can be used with DocMagic’s comprehensive, single-source Total eClose platform.

annitti was selected thanks to several key accomplishments over the last year that led DocMagic to success. One of the main accomplishments was the April launch of AutoPrep, a new technology that leverages AI, OCR, and machine learning technologies to fully e-enable a document for paperless eClosings. This means any loan document from virtually any provider can be used with DocMagic’s comprehensive, single-source Total eClose platform.

AutoPrep was a significant R&D investment and technology strategy to help more lenders perform eClosings.

”I’m a firm believer that these innovations work to establish much-needed interoperability between disparate systems and critical entities within the digital mortgage ecosystem,” Iannitti told PROGRESS in Lending. “Our goal is for our industry-leading eClosing platform to be completely open, handling documents from all vendors and sources without any manual effort or additional labor required.”

Iannitti was also recognized for helping DocMagic clients adapt to the pandemic environment, including social distancing measures and work-from-home (WFH) orders. Numerous lenders used Total eClose to execute mortgage closings electronically. Additionally, as more states passed emergency remote online notarization (RON) laws, Iannitti ensured that DocMagic was ready to quickly and effectively respond to clients’ urgent need for RON within the Total eClose platform.

Related Content:

Let us digitally transform your mortgage process for increased efficiency and ROI. See how by scheduling a demo today.

Topics from this blog: Awards

BackSearch the Blog

- Recent

- Popular

- Topics

List By Topic

- Compliance (100)

- eClosing (85)

- Awards (72)

- eSign (71)

- Integrations (57)

- Industry Publications (52)

- Total eClose (44)

- eNotes (34)

- Remote Online Notarization (31)

- Document Generation (30)

- eDisclosures (25)

- GSEs (18)

- eVault (18)

- eNotary (16)

- SmartCLOSE (13)

- LoanMagic (12)

- eDelivery (11)

- Partnerships (8)

- Philanthropy (8)

- Industry Insight (5)

- AutoPrep (3)

Subscribe Here

Download the Truliant Federal Credit Union Case Study

Truliant took several key steps to refine its 100% digital eClosing process — including finding the right technology partner.