Should longtime-RON holdout California allow it? Secretary of State considers it

Last week the new Secretary of State of California — a state which has been one of the most resistant to remote online notarization (RON) — held a lively and heavily attended Zoom briefing to discuss whether California should allow the technology.

Dr. Shirley N. Weber, who was sworn into office in February, invited experts to discuss the pros and cons of RON. She stressed that she has not yet taken a position on RON but sought to learn as much as possible, noting that she’ll likely be asked to weigh in on any legislation.

“We in California are concerned about [RON] because we surely want to make notarization convenient, we want to make it accessible to so many individuals and utilize the tools that are available now to accomplish that, but we also want to do it by protecting the interest of Californians against fraud,” Weber said.

Here are the 5 main hurdles to eClosing implementation — and how to overcome them

Interest in the April 28 informational briefing was so high that attendance instantly reached the maximum capacity of 500 people and several people were initially locked out of the Zoom as a result. Weber marveled that by the end of the almost two-hour-long meeting there were still 488 people watching. “Clearly this is an item of concern,” she said.

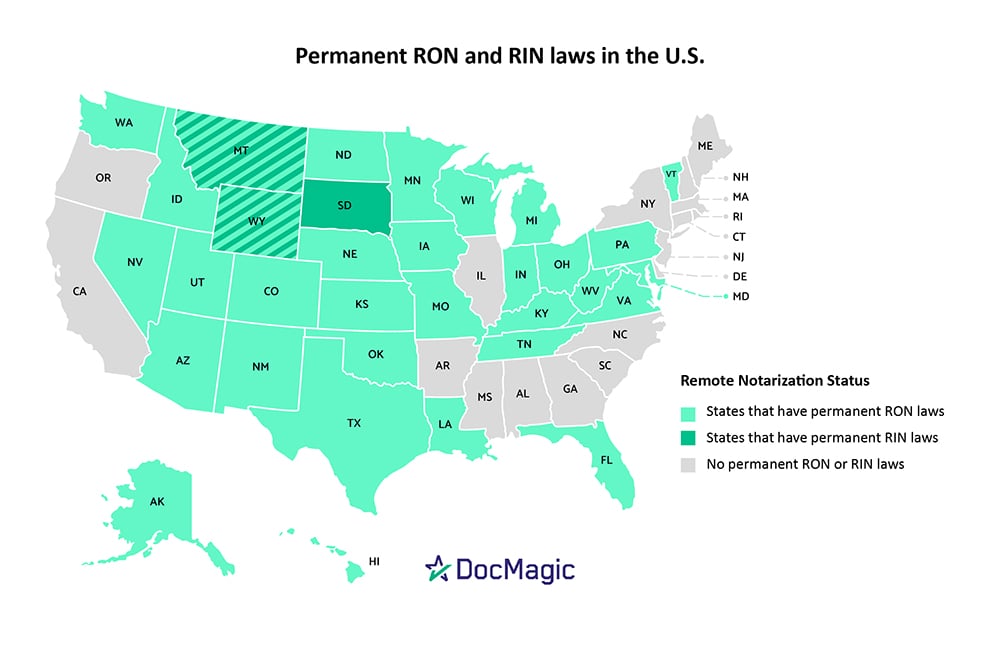

More states have been enacting permanent RON laws (distinct from the emergency orders that were passed in response to the pandemic). Since Wyoming became the first state this year to enact RON, another three states — Kansas, New Mexico and West Virginia — have jumped on board, which means 32 states now have permanent RON laws. Three states also allow remote ink-signed notarization (RIN).

California currently has a bill, AB 1093, that would allow RON.

However, its historical opposition to RON is well known; during the pandemic, California was one of just two states that didn’t even pass an emergency order to temporarily permit remote notarization. When bipartisan federal legislation was proposed last year to allow RON nationwide, then-Calif. Attorney General Xavier Becerra urged Congress to abandon the effort, calling it “a solution in search of a problem.” Such opposition from a large and powerful state likely helped doom the bill’s chances.

For the briefing, Weber invited three experts to make or break the case for RON in California:

Lori Hamm, Notary Program Specialist at the Montana Secretary of State’s office

Hamm oversees the RON program in Montana, which enacted its law in 2019. Some of her key points:

- RON is used for a lot more than just mortgages. In Montana, most of the remote notaries are lawyers and paralegals who practice elder and estate law. “They realize the benefits of having the audiovisual recordings to substantiate the capacity and willingness of the principals, and of course the benefits of social distancing when dealing with vulnerable populations,” she said.

- Many of the temporary emergency RON orders are insufficient. They’re “stretching the concept of personal appearance and contemporaneous completion of the notarial certificate to what I think is a dangerous degree,” Hamm said. “And I suspect that there will be a number of notary authorities who may get rich as expert trial witnesses as some of these laws get challenged down the road.”

Matt Miller, President and Founder of The California League of Independent Notaries

Miller acknowledged that there is an appetite for RON, but said he still had several concerns. Some of his key points:

- Data privacy is a major concern. At a time when there are still too many data breaches, Miller said it’s worrisome that an online notarial transaction collects even more personal data than a traditional notarial transaction, such as identity credentials, facial features, a person’s voice and the contents of personal legal documents.

- Liability protections for online notaries aren’t strong enough. RON platform providers handle the identity verification that, in a traditional notarial transaction, would normally be done by the notary. However, if the provider “fails to vet identity properly and then fraud occurs, these companies could point to the notary and effectively shield themselves from all liability,” Miller said. “This is undesirable for practitioners and potentially harmful to the public.”

Craig Page, Executive Vice President and Counsel at the California Land Title Association (CLTA)

Page said CLTA employs thousands of notaries and notarizes millions of documents in the state. Some of his key points:

- CLTA had previously opposed RON — but not anymore. Three years ago, CLTA came out against a RON bill. Now they firmly support the practice. So what changed? Page said over the last few years other states have strengthened their laws to make them more secure; MISMO has been setting stringent standards; California passed laws to further protect consumer privacy; and RON platform providers, facing increased competition, have improved their systems.

- California’s anti-RON stance hurts it on the secondary market. At the federal level, Fannie Mae and Freddie Mac both accept RON closings. “Because we don’t have a RON program in California, this unfortunately puts California-generated loans at a disadvantage when it comes to marketability in the secondary market to investors,” Page said.

One facet of notarization unique to California is that notaries are required to keep the signer’s thumbprint in their notary journal. Miller noted that this requirement helps deter fraud and has been used by the state’s criminal justice system to solve crimes involving “fraud, abuse, and even murder.”

Page responded that while the thumbprint requirement has been useful, RON’s audiovisual requirement — capturing a potential felon’s image, voice, mannerisms and identity credentials — would serve as a stronger deterrent to crime.

Miller and Page also clashed over the fact RON is already affecting mortgages in the state. Miller noted that currently, a California resident can use an online notary in another state, possibly one with lower standards. He called for legislation to disallow that practice.

Page, however, said that according to the U.S. Constitution’s interstate commerce clause, documents legally notarized by RON notaries in other states must be accepted in California. Thus, the state’s current antipathy to RON merely ensures that California’s mortgage closing business goes to other states’ remote notaries.

“Numerous large county recorders in California are accepting RON-notarized documents from out of state,” he said. “Madam Secretary, I would argue that this fact alone behooves California to pass the RON programs as quickly as possible.”

The bulk of the briefing’s attendees were notaries. Their questions included how much it costs to become a remote online notary; how the e-signing and identity verification works; and technical questions about software and video storage.

In response to a query about how long it takes to become a remote notary, Hamm said that during the first six months of Montana’s law, only about a half-dozen notaries got qualified to conduct RONs. Then the pandemic hit.

“We went from six to 298 in about six weeks,” she said. “Things like pandemics certainly change the landscape.”

Before ending the briefing, Weber promised that her office would continue to monitor RON efforts in the state. She added, “Change is never easy, it’s always difficult, but … oftentimes when change happens people are surprised that it took so long for them to realize that change can be good.”

Related Content:

Let us digitally transform your mortgage process for increased efficiency and ROI. See how by scheduling a demo today.

Topics from this blog: Remote Online Notarization

BackSearch the Blog

- Recent

- Popular

- Topics

List By Topic

- Compliance (100)

- eClosing (85)

- Awards (72)

- eSign (71)

- Integrations (57)

- Industry Publications (52)

- Total eClose (44)

- eNotes (34)

- Remote Online Notarization (31)

- Document Generation (30)

- eDisclosures (25)

- GSEs (18)

- eVault (18)

- eNotary (16)

- SmartCLOSE (13)

- LoanMagic (12)

- eDelivery (11)

- Partnerships (8)

- Philanthropy (8)

- Industry Insight (5)

- AutoPrep (3)

Subscribe Here

Download the Truliant Federal Credit Union Case Study

Truliant took several key steps to refine its 100% digital eClosing process — including finding the right technology partner.